SCOTT C. WINN

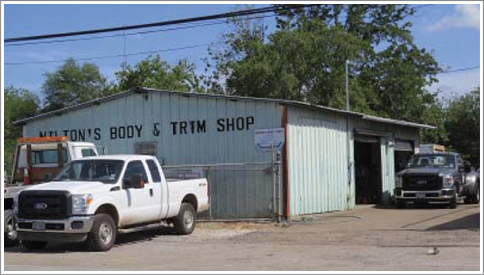

My experience over the past 30 years has been as an investor in seller financed real estate notes and distressed properties. I am passionate about purchasing “scratch and dent” assets and developing them into cash-flow machines for passive income, and can help you do the same.

I’ll admit I had to read the Rich Dad Poor Dad books twice, because I didn’t “get it” the first time! Years later, the lessons sunk in and became the lens through which I view all investments.

I’m a lateral thinker and excel at finding creative solutions to real estate problems — problem properties, problem loans, problem borrowers. Designing efficient, productive systems for managing real estate projects makes me happy.

Let’s talk and explore how I can help accelerate your success.